Expanding business into Dubai provides Australian companies with a gateway to the Middle East, Africa, and Asia. Dubai’s stable economy, modern infrastructure, and investor friendly regulatory framework make it a top choice for businesses aiming to grow internationally. Setting up a Dubai subsidiary allows an Australian company to operate independently, manage local operations, and directly access regional markets.

BizHub provides professional support to Australian companies looking to set up a Dubai subsidiary, including legal requirements, registration steps, cost guidance, and operational compliance. Learn more about our Dubai business setup services for Australians

What is a Subsidiary Office?

A subsidiary office is a separate legal entity formed in Dubai, either wholly or partially owned by the parent company. Unlike a branch office, a subsidiary can hold its own trade license, hire employees, sign contracts, and operate independently. This structure provides limited liability protection for the parent company and is suitable for businesses planning long term operations in the UAE.

Benefits of Setting Up a Dubai Subsidiary

1. Full Ownership in Free Zones

Many Dubai free zones allow 100% foreign ownership, giving Australian companies complete control over business decisions and operations.

2. Access to Regional Markets

A subsidiary can operate in Dubai and across the UAE, enabling direct trade with clients and business partners in the region.

3. Legal Protection and Liability Management

A subsidiary is a separate legal entity, so liabilities remain with the UAE entity, protecting the Australian parent company.

4. Operational Flexibility

Subsidiaries can open bank accounts, sign agreements, and hire staff independently.

5. Eligibility for Visas

Subsidiaries can sponsor UAE residency visas for investors, employees, and their families.

Mainland vs Free Zone: Choosing the Right Location

Choosing the right location is the first step in setting up a subsidiary. Learn more about Mainland vs Free Zone vs Offshore business setups in Dubai to determine which option suits your company.

Mainland Dubai

- Permits direct business with clients across the UAE.

- Suitable for trading, consultancy, and professional services.

- May require a local service agent for certain activities, but selected sectors allow 100% foreign ownership.

- Physical office space is mandatory depending on the business activity.

Free Zones

- Designed for foreign investors with simplified setup procedures.

- Allow full ownership for most business activities.

- Operations are generally limited to the free zone unless a local distributor is appointed.

- Flexible office options include virtual offices and coworking spaces.

Popular free zones for Australian companies include DMCC, JAFZA, RAKEZ, and IFZA.

Documents Required for Australian Companies

Corporate Documents

- Certificate of incorporation from Australia

- Memorandum and Articles of Association

- Board resolution approving Dubai expansion

- ASIC company extract or certificate of incumbency

- Passport copies of shareholders and directors

Personal Documents

- Passport copies

- Passport sized photographs

- Proof of residential address

Attestation Requirements

All corporate documents must be notarized in Australia, attested by the UAE Embassy, and approved by the UAE Ministry of Foreign Affairs. This ensures recognition by Dubai authorities for company registration.

Investing from Australia into a Dubai Subsidiary (ODI Context)

When an Australian company invests in a subsidiary office in Dubai, it falls under Overseas Direct Investment (ODI), because the company is acquiring significant ownership and operational control.

Key Considerations for ODI:

- Ownership and Control: Investments that provide more than a minor stake (usually over 10%) in a Dubai subsidiary qualify as ODI.

- Non Equity Commitments: Loans, guarantees, and pledges linked to the Dubai subsidiary also count toward ODI.

- Limits on Investment: Companies must manage capital allocation carefully to ensure the total financial commitment remains within regulatory thresholds set by Australian authorities and Dubai banking limits.

- Prohibited Sectors: ODI does not cover speculative real estate, gambling, or certain regulated financial products unless approvals are obtained.

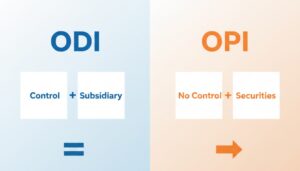

ODI vs OPI for Australian Companies in Dubai

- ODI (Overseas Direct Investment):

- Involves significant ownership or control in a Dubai company.

- Examples: setting up a subsidiary or branch office.

- Provides operational influence and management rights.

- Suitable for long term business expansion and regional operations.

- OPI (Overseas Portfolio Investment):

- Involves minor financial investments in foreign securities.

- Does not confer management or operational control.

- Focused on financial returns rather than running the business.

- Easier to liquidate and typically short term or medium term.

- Key Takeaway:

- Understanding ODI vs OPI helps Australian companies structure Dubai investments correctly and comply with regulations while planning for growth and control.

Step-by-Step Process to Set Up a Subsidiary

Step 1: Choose the Location

Decide between mainland Dubai or a free zone based on your business activities, ownership preference, and target market. For complete assistance with selecting the right structure and obtaining your UAE trade license, visit our Business Setup & Licensing Service.

Step 2: Reserve the Company Name

Submit name options that comply with Dubai’s naming regulations.

Step 3: Define Business Activities

Select activities that match corporate objectives and meet UAE regulatory requirements.

Step 4: Initial Approval

Submit corporate documents to the relevant authority for initial approval.

Step 5: Sign Articles of Association

Finalize ownership structure, capital allocation, and governance rules.

Step 6: Lease Office Space

Free zones allow virtual or flexi offices, while mainland Dubai often requires physical premises.

Step 7: Obtain Trade License

Once approved, the trade license is issued, officially registering the subsidiary.

Step 8: Apply for Establishment Card and Visas

This enables the subsidiary to sponsor employee and investor visas.

Step 9: Fund the Subsidiary

Transfer investment capital from Australia following regulatory compliance, ensuring that all ODI requirements are met.

Step 10: Maintain Compliance

Annual financial statements, VAT registration, corporate taxes, and trade license renewal are mandatory for continued operations.

Cost Considerations

|

Cost Component |

Free Zone (AED) | Mainland (AED) |

|

Trade License |

15,000 – 50,000 |

20,000 – 60,000 |

|

Office Space |

10,000 – 20,000/year (flexi desk) |

40,000 – 100,000/year |

|

Document Attestation |

2,000 – 5,000 |

2,000 – 5,000 |

|

Investor Visa |

3,000 – 6,000 |

3,000 – 6,000 |

| Family Sponsorship | 3,000 – 5,000/person |

3,000 – 5,000/person |

Bank Account and Financial Setup

A corporate bank account is essential. Documents typically required include:

- UAE trade license

- Office lease agreement

- Board resolution approving the subsidiary

- Australian parent company incorporation documents

- KYC documentation for shareholders and directors

Most major banks in Dubai provide corporate banking services, including multi currency accounts, online banking, and trade facilities. Australian companies can also get help opening corporate bank accounts in Dubai through BizHub’s Banking Assistance Service.

Regulatory Compliance

A Dubai subsidiary must comply with UAE laws and regulations:

- File financial statements annually with the free zone or Department of Economy.

- Maintain proper accounting records.

- Comply with VAT and corporate tax requirements.

- Renew trade licenses annually.

Non compliance can lead to fines, license suspension, or operational disruption, so consistent monitoring is crucial. To maintain compliance with VAT, accounting, and annual reporting obligations, explore BizHub’s Accounting & Bookkeeping Services

Conclusion

For Australian companies, setting up a Dubai subsidiary is a strategic move for long term regional expansion. It allows 100% ownership in free zones, operational flexibility, and the ability to sponsor visas for investors and employees. Careful planning, adherence to regulatory requirements, and correct classification as ODI ensure smooth operations and legal compliance. BizHub guides Australian businesses through each step, from document preparation to licensing and visa processing, ensuring a seamless and compliant setup in Dubai.

FAQs

- Can an Australian company fully own a Dubai subsidiary?

Yes, most Dubai free zones permit 100% foreign ownership. Mainland Dubai may require a local service agent for certain activities, but select sectors allow full foreign control. - How long does it take to set up a subsidiary?

Setting up a Dubai subsidiary usually takes 4–6 weeks, depending on attestation of documents, regulatory approvals, trade license issuance, and corporate bank account setup. Delays may occur if paperwork is incomplete. - What documents are required?

Required documents include corporate records like the certificate of incorporation, MoA/AoA, and board resolution, plus personal documents such as passport copies, passport sized photos, and proof of residence for shareholders and directors. - Can the subsidiary sponsor visas?

Yes, a Dubai subsidiary can sponsor UAE residency visas for investors, employees, and family members, including dependents, enabling legal employment and residence in the UAE while complying with immigration regulations. - What is the difference between ODI and OPI in this context?

ODI involves direct investment with control, such as establishing a subsidiary, while OPI refers to minor financial investments in foreign securities without operational or managerial control over the company.